costa rica taxes for us expats

Transfer tax around 15. Persons With Respect to Certain Foreign Corporations Form 5471 and.

10 Tax Tips For U S Citizens Living In Costa Rica In 2021

In Costa Rica the tax year is October 1 to September 30 and your return must be filed by February 15 each year.

. And a few lesser fees such as a registry fee municipal fee fiscal fee bar association fee archive costs etc. The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. Western suburbs of Escazu and Santa Ana are becoming more and more attractive locations for expats.

This involves a property transfer tax. Escazu is definitely one of the trendiest and most upscale suburbs of San Jose. 9996 is chock-full of incentives and benefits for new expats in Costa Rica.

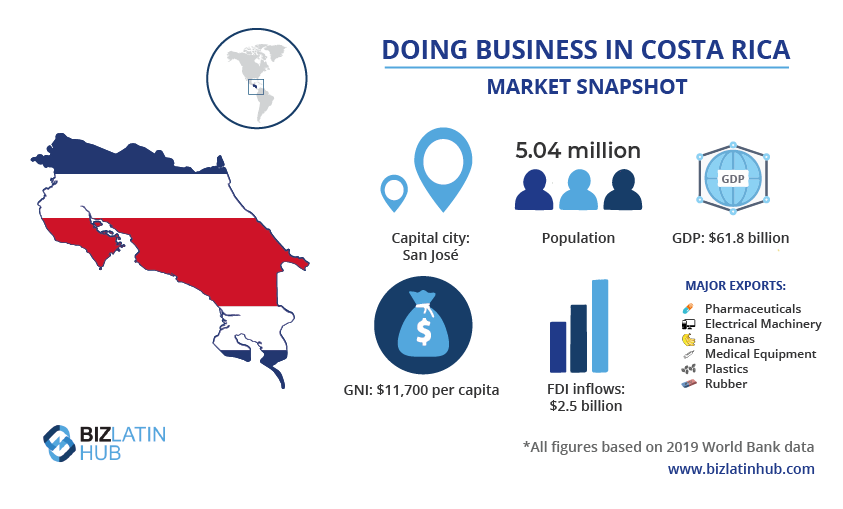

Return for all the years that you are. Active corporations that earn up to 51 million have to pay 25 of minimum wage yearly 106250. Costa Rica is a popular expat destination especially for US citizens.

You should speak with a Board-Certified Tax Law Specialist before taking a position on your tax return. Legal fees 1-2. Tax Planning for US Expats in Costa Rica.

Costa Rica Pension Plan US Tax. Costa Rica Taxes Tax Saving Tips for US Expats Foreign Earned Income Exclusion. Citizens living overseas comply with their IRS filing obligations.

Non-residents including Americans who spend less than 183 days a year in Costa Rica are also subject to a flat withholding tax on any Costa Rican income they may have at either 10 15 or 25 depending on the income type. With relatively cheap costs of living great private healthcare options wonderful weather and welcoming and friendly local residents Costa Rica does not only attract people who want to retire there but also younger people with freelance jobs or even young families. Property tax in Costa Rica is one of the lowest in the world it is 025 of the registered value per year.

Costa Rica has a lot to offer expats with its tropical climate eco-friendly culture beautiful beaches welcoming people good healthcare system and relative safety. All told they can easily eclipse 10000 in tax savings. Non-active corporations have to pay 15 of minimum wage yearly 63750.

Tax International based in San Jose Costa Rica specializes in helping US. Since there is no US tax treaty with Costa Rica foreign pension in Costa Rica is usually taxed on growth as well as contributions made to the foreign pension plans by US Persons. The US is one of the few countries that have this type of expat tax in a bid to avoid its.

If you pay income tax in Costa Rica there are several exemptions that allow you to pay less or no income tax on the same income to the IRS. Your Costa Rica tax return is due on February 15 for the year prior. Up to 500000 colons US77884 750 colons tax US117 Over 500000 but less than 2000000 US311535 6000 colons tax US935 Over 2000000 but less than 4000000 US623070 12000 colons tax US1869 Over 4000000 colons US623070 18000 colons tax US2804.

Some of the preferential tax treatments or benefits for US ex-pat tax in Costa Rica include. Its residents enjoy the calm laid back feel of the town while being in close proximity to the capital. The Foreign Earned Income Exclusion will exclude up to 80000 of earned income wages.

When property is purchased in Costa Rica it must be transferred into the buyers name. A foreign tax credit is granted for income made in. 4 Claim tax credits when you file.

Citizen or a resident alien of the United States and you live in Costa Rica US expat tax will be based on your worldwide income and as such you must file a US. Expat Living in Costa Rica. Healthcare in Costa Rica Costa Rica is has both public and private healthcare systems.

US expats need to pay taxes when it Costa Rica or when it any other country around the world. Tax International we will help you file your annual Form 1040 Report of Foreign Bank and Financial Accounts FBAR Information Return of US. Corporations that earn between 51 million and 119 million have to pay 30 of minimum wage yearly 127500.

The Foreign Earned Income Exclusion lets expats who can prove that they are either permanent residents in Costa Rica or that they spend at least 330 days outside the US in the year exclude the first. US expats living and working in Costa Rica must submit a US income tax return. The primary one is the Foreign Earned Income Exclusion which lets you exclude the first around US100000 of foreign earned income from US tax if you can prove that you are a Costa Rican resident.

Remember though that even if. The church and park of Escazu. For US expats earning under around 100000 and paying less Costa Rican tax than the US tax due the Foreign Earned Income Exclusion could be a better option.

You can request an extension on your US expat taxes until October 15 if you need more time to file. The US tax year runs January to December with US resident returns due in April and US expat tax returns due June 15. Benefits of the Law to Attract Investors and Retirees.

Corporation Tax Rates in Costa Rica. Tax Guide for US Expats Living in Costa Rica Wherever you live in the world you are obligated to file a US tax return with the IRS reporting your worldwide income. She only works overseas but makes frequent trips back to the US to visit friends family for 50.

Costa Rica also has a small property tax of 025 of the value of property paid annually. Foreign Earned Income Exclusion and foreign housing exclusion If you are a US. Along with the regular US expat income tax return many individuals are also required to submit a report disclosing assets in foreign banks and financial accounts or FBAR by using.

How To File Us Taxes When Living In Costa Rica Online Taxman

Tax Guide For Americans Living In Costa Rica Greenback Expat Tax Services

International Taxes In Costa Rica What You Need To Know

Important Taxes For Expats Archives Costa Rica Expertise

A Vast Coastline Tropical Forests And Eco Friendly Living Are Just Some Of The Major Attractions That Draw Expats Voyage Costa Rica Costa Rica Conseil Voyage

Costa Rica Expat Taxes Ultimate Tips You Need To Know

12 Top Expat Tax Tips And Services For Living In Costa Rica

The Taxation System In Costa Rica Tax In Costa Rica

Us Taxes On Money Earned In Nicaragua San Juan Del Sur Nicaragua Us Tax

Myexpattaxes Review What U S Citizens Living Abroad Forget Living Abroad Travel Jobs Abroad

A Beginner S Guide To Costa Rican Tax For Us Expats

3 Important Income Tax Consequences When Living In Costa Rica

A Beginner S Guide To Costa Rican Tax For Us Expats

What Us Expats Need To Know About Filing Their Tax Return When Living Abroad Expat Investment Advice Investment Tips

Costa Rican Taxes For U S Expats 8 Things To Know About Tax Returns

U S And Costa Rican Taxes Too Often Neglected By Expats American Expatriate Costa Rica

Us Expat Taxes For Americans Living In Costa Rica Bright Tax

New Taxes And Obligations In Costa Rica Know Before You Invest